State payroll calculator

716 878-3068 kawalelbuffalostateedu Some content on this page is saved in PDF format. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

State regular employees who are otherwise eligible will receive an increment on July 1 2022 or January 1 2023 based on the employees entry-on-duty EOD date.

. Other Oregon deductions and modifications. Oklahoma State Payroll Taxes. The process is simple.

Oklahoma State Unemployment Insurance SUI Oklahoma has a State Unemployment Insurance. While the State Revenue Office makes every attempt to ensure the accuracy and reliability of the automatic calculations provided in this service you will acknowledge that there may be instances where the State Revenue Office is required to recalculate the figures submitted for assessment. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll.

It uses the employees basic and dearness allowance minimum wage in the state and the statutory bonus percentage to compute the bonus. Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance. The Paycheck Calculator below allows employees to see how these changes affect pay and withholding.

Paychex Flex 800-741. 24 new employer rate Special payroll tax offset. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

In addition to federal income tax most US. State Unemployment Insurance Calculator. This calculator can only be used for reference purposes.

Payroll check calculator is updated for payroll year 2022 and new W4. Buffalo State 1300 Elmwood Ave Cleveland Hall 403 Buffalo NY 14222 Phone. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions.

Exempt means the employee does not receive overtime pay. Withhold all applicable local state and federal taxes. 716 878-4822 Fax.

Welcome to Payroll part of the Human Resources team Who We Are As part of the Total Rewards Operations Center team in Human Resources Payroll is available to process paychecks taxes and direct deposit forms and help with all other payroll processes. Global Payroll Calculator is always up-to-date with the latest tax regulations in 190 countries so you can plan international employment costs accurately. States collect a state income tax from employees.

2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. 686 form to reflect the redesign. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Employees who wish more information on state and local taxes withheld should consult a tax professional or. Switch to hourly calculator. Employer burden contributions.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Previously filed Oregon or federal. Then enter the employees gross salary amount.

The Statutory Bonus Calculator is a free tool developed by Zoho to calculate the amount of statutory bonus that an eligible employee can get in a financial year. Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance.

Run payroll for hourly salaried and tipped employees. You will want to be sure of the state income tax rules in. Oregon personal income tax withholding and calculator Currently selected.

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State Unemployment Insurance and others. Free 2022 Employee Payroll Deductions Calculator. 09 Taxable maximum rate.

The State Controllers Office has updated the Employee Action Request STD. 54 Taxable base tax rate. Maintaining an active approach to State Unemployment Insurance SUI tax rates can help ensure you are not only compliant but not spending more than you must.

Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. The amounts withheld for state and local income tax depends upon whether the applicable state and locality require payroll deduction of taxes and how the taxes are to be figured if so. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022.

If youre a new employer congratulations by the way your rate will be 15. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. The good news is that only the state charges income tax so theres no need to worry about local taxes.

Also referred to as take home pay this is the salary amount an employee receives after all deductions. Payroll Time Attendance Benefits Insurance HR Services Support. State or province imposes.

We designed a nifty payroll calculator to help you avoid any payroll tax fiascos.

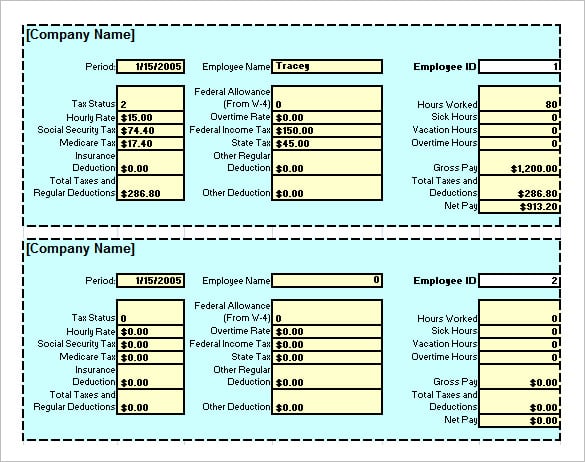

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

How To Calculate Net Pay Step By Step Example

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Calculator With Pay Stubs For Excel

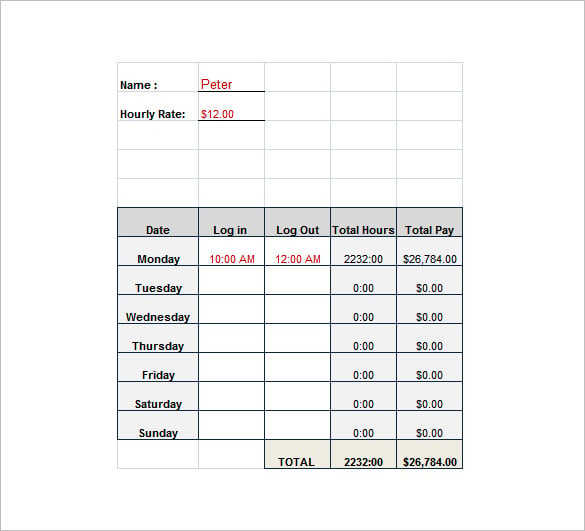

Payroll Calculator Free Employee Payroll Template For Excel

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Online For Per Pay Period Create W 4